All views and/or recommendations are those of the concerned author personally and made purely for information purposes. These articles, the information therein and their other contents are for information purposes only. Using this facility, you can generate rent receipts in minutes. app is among the opt used online rent receipt generating platforms in India. With digital rent receipts, you are helping save the trees by not wasting paper. Your little efforts go a long way in saving the planet. All you have to do is provide the basic details and the rent receipt will be generated in a matter of minutes. To save time and energy, tenants can opt for automated rent receipts on online platforms like Housing Edge.

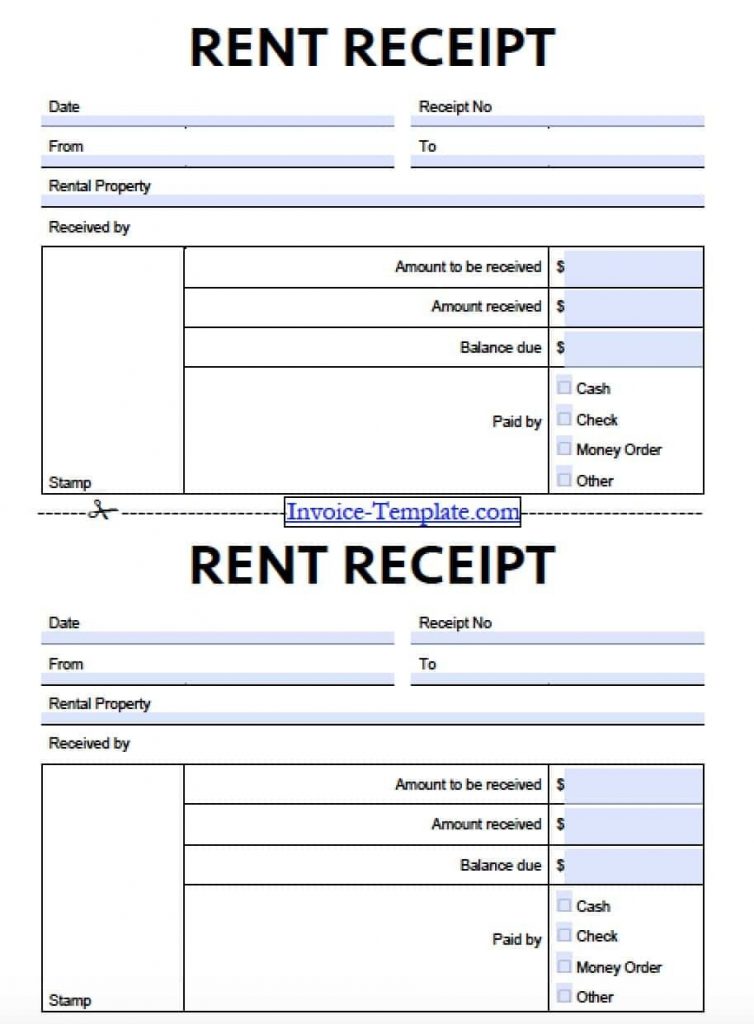

RENT RECEIPT PDF FREE

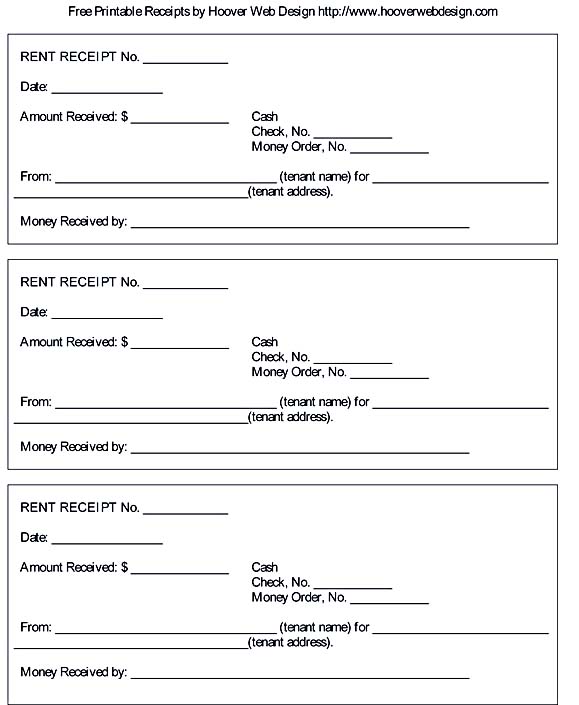

Using the Housing Edge app, for instance, landlords and tenants can easily generate rent receipts free of cost. These days, online service providers offer the facility to generate digital rent receipts online. Tenants don’t have to go the old way to buy rent receipts from vendors. Digital rent receipts for easy record-keeping For this, you will need to calculate the exempt HRA amount manually. However, you can claim HRA exemption in your ITR. In case you fail to submit rent receipts on time, your employer will deduct the entire amount taxable as TDS according to your tax slab. What if I fail to submit rent receipts to my employer? Remember that for income tax purposes, expenses are considered on a financial year basis and not the calendar year basis. for 3 month period, for half-yearly period or for an annual period according to the financial year. No, rent receipts can be submitted for an entire quarter i.e. Even if you are paying your rent through credit card or other online money transfer channels, you need to procure rent receipts from your landlord and submit the same to your employer to claim HRA deductions. Your employer will ask you to submit the rent receipts before the end of the financial year, typically between January and March. Yes, aside from quoting the landlord’s PAN, you will also have to provide a self-attested copy of his PAN along with the rent receipt.

Only those tenants have to provide PAN of the landlord who are paying a monthly rent of Rs 8,333 or Rs 1 lakh per year.

Re 1 revenue stamp is used on each rent receipt. What is the value of the revenue stamp used on the rent receipt? Those paying rent to their parents must also provide rent receipts as proof of payment in order to claim HRA deduction. It is mandatory to provide the rent receipt to your employer if you want to claim HRA for rental accommodation with a monthly rent payment of over Rs 3,000.

0 kommentar(er)

0 kommentar(er)